We manage portfolios tailored to your needs

We have a team that manages portfolios based on each client's particular risk profile. It also defines investment policies by identifying opportunities with a long-term vision. In addition, we select assets using a methodology that focuses on fundamental analysis, from the macro environment to the financial health of companies.

Your investments are in a safe place

We have partnerships with a highly qualified group of custodians that we make available to you so that you can rest assured that your money is well safeguarded.

* Lifeinvest, as a registered investment advisor in the United States, can provide its services through an advisory contract, regardless of the company where you maintain custody.

Other

custodians *

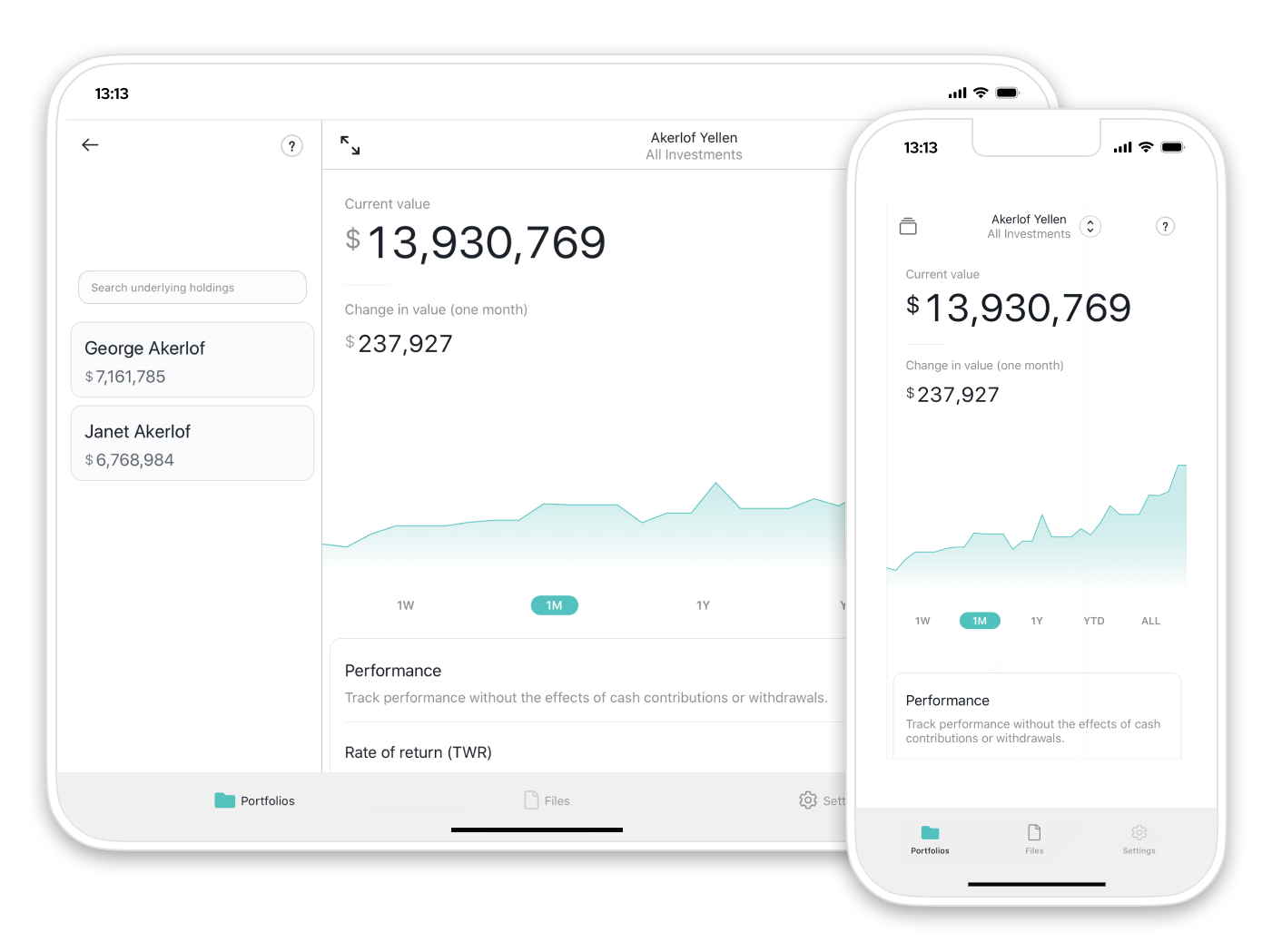

We use technology to make your portfolio more efficient

Our clients have access to Addepar, the industry-leading portfolio performance reporting and analysis software. This tool enables our Wealth Management team to make timely and accurate decisions, allowing the client to have a personalized experience.

Consolidate all your assets and view them on a single platform from any device

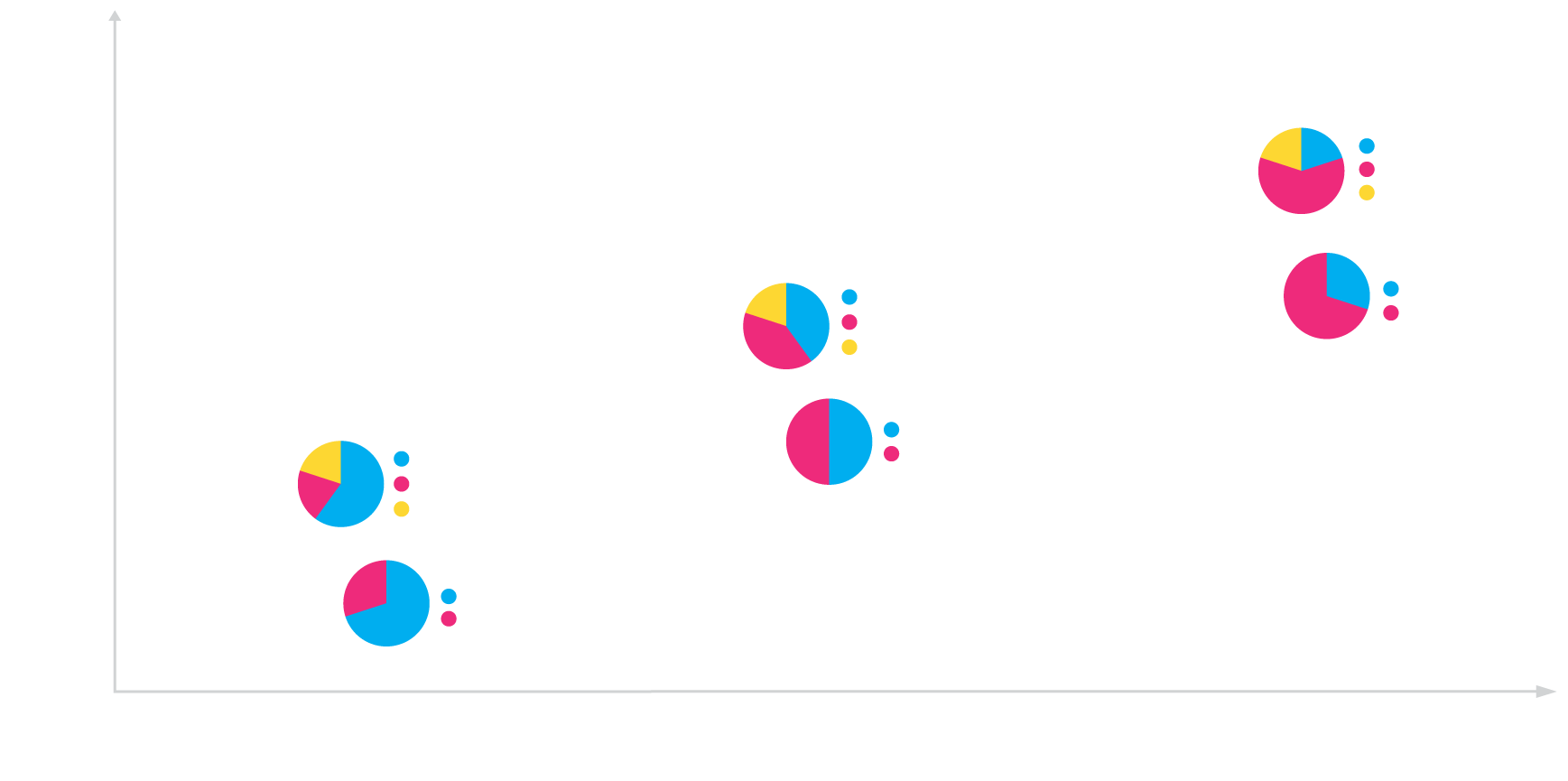

We use alternative investments to differentiate your portfolio

Alternative investments are complementary strategies to traditional assets such as stocks, bonds, and cash. In an environment where traditional investment portfolios can be inefficient, alternative investments play a valuable role in portfolios.

Recent studies have shown that by including 20% of alternative products in traditional investment portfolios (stocks and bonds), over the last 32 years they would have yielded an average of an additional 0.65%, with a 1% decrease in risk, making portfolios more efficient.

We help you connect with financing options

In an ever-changing world, financing needs are becoming increasingly important for all sectors of the economy. That's why at Lifeinvest, we have partnerships to connect our clients with the necessary financing solutions.